A Calculus-free Guide to Lifetime Value

Lifetime value. We’ve talked about how to calculate it, how to simplify the calculation, why to focus on it, how to use it in acquisition, and how and why to segment by it.

In short: we are fans. As you will see in this post, it’s a simple way of understanding and adjusting your program, donors, and channels.

But it can be daunting. It involves summing an infinite series of numbers, which means calculus. At least for me, calculus is more relevant as “stuff that builds up on your teeth” than “thing you studied in high school.”

So let’s have technology do the work for us with Excel or Google Sheets or whatever spreadsheet program you have available. We’ll use 2018’s average retention information from the Fundraising Effectiveness Project as our example.

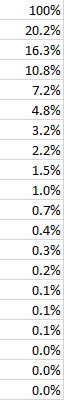

Step one: build a column of what your retention rates will be. Here, I started with the first-year retention rate of 20.2%. For the subsequent years, I used a formula of

Previous year’s retention * multiyear retention rate +

Two years ago’s retention * recapture rate

Then, copy that formula for your chosen lookback period. It should look something like this:

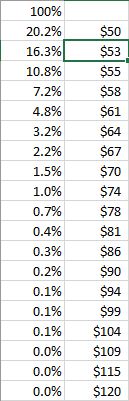

Step two: in the next column, put the value that you would get per period (in this case, per year). For this example, I assumed you acquired someone at a $30 average gift and get 1.6 gits per year from them ($50 in year one). I further assumed that each year would have an increase of 5%:

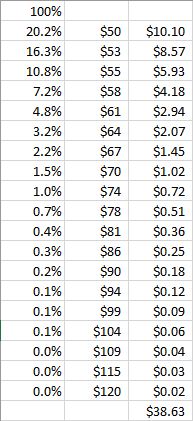

Step three: in the third column, multiple the value from column one and the value from column two, then sum that column:

Voila. Which is French for “here’s your lifetime value calculation.” In this case, a donor acquired for $30 with these metrics will give an additional $38.63 in the next 20 years.*

Why is this important? Because if you are acquiring these donors for $40, you must:

- Decrease your acquisition cost,

- Increase your retention,

- Increase the amount you get from your donors each year,

- Stop acquiring donors in this way, or

- Reconcile yourself to the fact you are using donor dollars to subsidize the people you are paying to run your acquisition and retention programs.

If you aren’t doing this calculation, you may be doing this last bullet point unconsciously. There is a major nonprofit doing both door and street face-to-face fundraising. They did this calculation and found their door-to-door operation was more than doubling their investment over five years. Their street operation, however, was making less money than if they had bought U.S. treasury bonds.

(Why? While I don’t know this nonprofit’s specific retention data and couldn’t share it if I did, Target benchmarking finds face-to-face done door-to-door has an average 13-month retention rate of 55%; street fundraising has a retention rate of 33%. As you will see from your own Excel calculations, retention rate compounds, making more of a difference to these calculations than anything else.)

I did this for a program I ran once upon a time, trying to find the difference between premium-acquired donors and non-premium acquired donors (a fun exercise if you are looking to justify additional cost-to-acquire to get a better donor). It turned out in this case, it didn’t matter – neither group was paying for themselves. As much as I hate to see organizations shut down acquisition, this is a clear sign to at least pull back to sustainable levels while you work and test to create a program that makes financial sense.

On the more optimistic side of the ledger, you can also use this to choose among good options. Should your push in digital fundraising be for one-time or monthly donors by default? It will depend by audience, but this lifetime value calculation can help you make the case for a monthly strategy that lags in the short term, but makes up for it with better retention and annual giving amounts.

Hope this helps,

Nick

* This is simplified – on one hand, it doesn’t take into account bequest gifts; on the other, it doesn’t take into account the cost of soliciting these donors. All in all, it should approximately balance out…

Roger,

Oh, how I hope to find a simple tool. I was lost at number one build a column of what your retention rates will be. How does one know what retention rates “will be.” How does one determine value per period?

Serious questions as I try to help clients determine LTV.

Ditto what Sophie said. 🙂

If you have a track record, use that as the baseline calculation. If not and you are looking at what your LTV would be if you were to invest, I’d recommend industry averages. For online and offline, you can use Fundraising Effectiveness Project data, F2F For Target Benchmarking, and the like. Other thoughts?

I should also mention the values I have in the sample column A above are the industry average per the Fundraising Effectiveness Project. So unless you have specific knowledge to the organization or a specific audience like sustainers, you can use these as a horseshoes and hand grenades estimate.