Are F-2-F Managers Squandering Millions?

I fear the answer is “Yes.”

Today there are at least a dozen major US nonprofits that are collectively spending tens of millions on F-2-F campaigns. My fear is that many are wasting their organization’s and their donors’ dollars because the Target Benchmark data on retention for F2F, street acquired sustainers is sobering and suggests to me that many (most?) will never see a return on that mammoth investment.

I hope I’m wrong. Indeed, in the case of some organizations I may be. But looking at the overall F-2-F scene –average costs, average gifts and average retention rates– I’ve come to the conclusion that either many F-2-F managers can’t count… don’t want to count…or are unable to grasp simple arithmetic.

First, Some Simple Arithmetic

Here are the assumptions on which I base my fears. Let’s use the acquisition of 1650 monthly F-2-F donors acquired from a street canvass for this illustration. Let’s further assume it takes one-year to acquire these donors and that the sign-ups are evenly distributed across the 12 months, producing 138 sustainers per month.

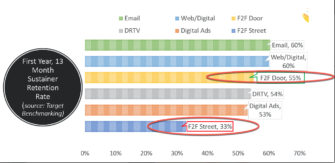

Note: Canvassing at the Door as opposed to on the Street presents a much rosier projection – with Target benchmarking indicating a 55% median retention at Month 13 as opposed to 33% on the Street. In fact, ”Door” groups are yielding a profit… but the vast majority of U.S. acquisition is street based so the far less rosy scenario that follows reflects closer to reality for most (not all) groups.

Here are the basic metrics that matter.

- Average Cost to Acquire a F-2-F Monthly Donor: $300

- Average Monthly Contribution:$25

- Number of sustainers recruited during year: 1650

- Median 13 month Retention Rate: 33% (per Target benchmarking)

- Gross Income at End of 12 Months: $163,500

- Net Income/Loss at End of 12 Months: (-$331,500 )

- Number of F-2-F Donors at End of Year One: 545

Year Two:

- Number of Active F-2-F Donors carried over from Year One: 545 (deducted loss of 1105 (67%) donors in month 12)

- Average monthly contribution in Year Two: $25

- Average retention rate in Year Two: let’s assume a wildly optimistic 1 percentage point loss each month between Month 13 and Month 24 leaving us with a Year Two retention rate of 22%.

- Gross Income from Year Two: $112,995

- Net Income/Loss at End of Year Two: (Year 1 + Year 2) (-$218,505)

- Number of F-2-F Donors at End of Year Two: 364

Year Three:

- Number of Active F-2-F Donors carried over from Year Two: 364

- Average monthly contribution in Year Three: $25

- Average retention rate in Year Three: assume a still optimistic 1 percentage point loss each month leaving us with a 10%, month 36 retention rate.

- Gross Income from Year Three: $63,861

- Number of F-2-F Donors at end of Year 3: 165

- Net Income/Loss at End of Year Two: (Year 1 + Year 2+ Year 3) (-$154, 644)

Consequently, at the end of the third year the Organization will have invested $495,000 to get a net loss of $-(154,644) and ends up with 165 donors to go into Year 4. But this horrific story gets worse. Given the Target Benchmark retention rates the Organization will run out of donors on or about Month 46 and it will still be in the hole by more than $150,000. There simply are no human beings left to keep paying. A nearly $500,000 investment produced a total income of approximately $350,000. And remember, this doesn’t include staff time or servicing the donors.

In short, the Organization would have been much better off taking $150k and burning it in a pile. They’d wind up with the same shortfall but would know it in about 20 minutes versus 46 months. And rather than invest the hours and hours of staff time their “soft costs” would be reduced to the cost of a match and marshmallows.

WHY? WHY? WHY?

Other than the simplistic and somewhat harsh conclusion that the F-2-F Manager of our illustrative charity can’t or won’t count, and that the CEO, CFO and Board are unaware or deliberately ignorant why is this happening?

More importantly, how can these numbers be improved?

Improving the Numbers.

Back in June, in the First Part of The Agitator’s four part series on F-2-F ( Part 2, Part 3, Part 4) I indicated that what will ultimately determine the fate of F-2-F as either a productive sustainer “oasis” or simply an expensive and wasteful “mirage” would be the retention rates. I then went on in the series to highlight those factors that most affect F-2-F retention.

Improvement #1. Move from Street to Door

In July we reported on the results of the Institute of Fundraising’s survey asking UK donors what they want when it comes to F2F fundraising. Since F2F is far more prevalent in the UK than in the US these results warrant repeating.

- People [in the UK] were more likely to engage with fundraising in both door and street F2F than fundraisers predicted.

- Door-to-door fundraising was viewed as positive (and above average) for its appearance, personalization, authoritativeness, and generally being a welcomed form of fundraising. Street beat the average for “ease of response” and “convenient.”

- People were more likely to donate, share, and research an organization than fundraisers expected for door.

The study concluded: “Door-to-door continues to be viewed as positive and strong, remaining one of the most effective fundraising methods to reach and engage large numbers of individuals across the UK.”

Certainly, for the US market the Target Benchmarking figures reinforce the value of “Door Channel” over the “Street Channel” After all, a 22 percentage point improvement in retention [33% Street vs 55% Door] would move the Organization from a 5 year lifetime value of $264 (that it spent $300 to acquire) to $698. This is the difference between losing money and making a very nice return.

So why do the majority of F-2-F organizations persist in sticking with “Street”? Volume. Once again, as happens in direct mail and digital fundraising, “volume” raises its ugly and destructive head.

The flow of ‘prospects’ on busy city sidewalks and in shopping malls is much greater than the slog of going door to door in neighborhoods. The canvasser can talk to more people per hour on the street than they can by knocking on doors. Thus, they get more “sales” per hour – which is the measure by which most canvassers and the firms they work for are compensated.

Quality of the donor and donor retention be damned!

Improvement #2. Care about Canvasser Training and Abusive Pay Structures

It’s more than ironic that a large nonprofit employing both a $5 million direct response acquisition program and a F-2-F program costing the same $5 million will cumulatively spend hundreds of hours and thousands of dollars on the preparation of their direct mail packages, but totally neglect any significant investment in the training and monitoring of its canvassers.

Most F-2-F operations care only about volume – the number of new donors acquired: period. Not the experience and satisfaction of the donor. And certainly not the retention rate.

Most F-2-F firms bonus and promote canvassers based mainly on the number of donors acquired. And some agencies pay a very low base wage and employ a heavy commission structure with some even going further by paying commission tied not just to the number of donors signed up but also higher commissions for higher ask amounts.

Human beings respond to incentives; it is our nature. Behavior often isn’t innate, it’s caused. A bonus (or heavy commission) structure tied exclusively to volume (and higher price point to make things worse) creates unavoidable pressure to close sales at any cost. But, if that “cost” is borne by the charity in the form of lousy retention, so be it. It is this volume-only mindset that assures the ultimate failure or sub-par performance of a F-2-F program.

The failing here is in not understanding that the canvassers are to F-2-F what the package and copy are to direct mail—the messenger and motivator to the donor. Ironically, there are hundreds of blogs, books and webinars on direct response copy and creative… hundreds of skilled copywriters employed in preparing the package…and endless testing aimed at “beating the control,” but sadly little or no serious thought and little testing and evaluation when it comes to the multi-million expenditure for F-2-F.

If you believe that experience and skill matter in fundraising, and if you’re involved with F-2-F you have to be concerned with the horrible churn rate among canvassers. The average tenure of a F-2-F canvasser is 40 to 60 days –something no other business would tolerate save for shady boiler room telemarketers and the graveyard shift at 7-Eleven.

Some of this churn is due to the fact that nonprofits who tout themselves as noble and caring turn a blind eye to the fact that their canvassers are paid below-living-wages. In short, like farmworkers picking lettuce their work is harshly tied to output – ahhh, once more “volume” rears its ugly head.

Just as concerning is that in the Request for Proposals (RFPs) I’ve seen over the years there are only a handful that ask the F-2-F vendor to detail the training and compensation practices for its canvassers. I know of one charity, globally, that has a Board level policy to not work with agencies that pay below a living wage. Does your organization have a Board level mandate of this sort? If not, why not? If ethics and morals don’t win the day, profit should.

It doesn’t have to — and shouldn’t — be this way.

In Part 4 of our F-2-F series I outlined questions around areas I consider most important in assuring a high-value, sustainable, and growing F-2-F program:

- The quality/training of the canvassers

- The experience and satisfaction of the new donor with the solicitation process

- The capture by the organization of key donor data, e.g. satisfaction, commitment, and donor identity

- The effective use of this information/data by the nonprofit to provide the best, personalized donor experience and assure maximum retention.

Every one of these four elements is essential if the ultimate business goal— maximizing total net lifetime value for your charity—is to be realized. Of these four, dealing with the volume issue and the proper training and compensation of canvassers lead the list.

Until these issues are properly dealt with F-2-F in the US will remain far from an “oasis” for attracting retaining monthly donors. Instead the odds are it will simply prove itself to be a high-priced and wasteful “mirage”.

Roger

It is hard to believe that a blog such as yours could publish numbers so obviously incorrect and misleading.

Firstly, the target numbers do not measure attrition (the number of cancellations), they measure payment rates which is a different thing. Regardless of that, if you have 33% retention at month 12, then at the beginning of the second month, yes, you have 33% of the first 168 donors signed up in the first month. But you have more than 33% of those signed up in month 2, and way more of those signed up in month 12. You are working out income spectacularly wrongly, in a post that has the audacity to criticise people who “can’t or won’t count”, despite your gross income and number of donors at month 13 being totally wrong, and this having a disproportionately bigger error in your subsequent years’ numbers.

I also find your rather simplistic notion about street vs door quite hard to stomach. The numbers don’t lie, but perhaps there is more to this than meets the eye. Perhaps F2F done at the door yields an older donor, more time for the conversation, and is conducted by an older fundraiser, who is better at communicating with a diverse group of people. Is it impossible to achieve this using street F2F? Of course not. The problem in the US is not street F2F, it is street F2F done badly. Door does force agencies and in-house teams (because let’s not forget that some of the very worst attrition in the US has come from a large in-house program who have used F2F in the street as a campaigning tool rather than a fundraising tool – their joint cost allocations will confirm this) to do better fundraising. But posting, in public, such poorly worked out numbers, with such over-simplified and misleading headlines and conclusions is of no benefit to the marketplace whatsoever.

I am happy to provide an accurate month-by-month income forecasting tool if you would like to correct your numbers in a future post.

John,

First off, I was sloppy in the writing, not the math.

The 168 does refer to a cohort, a cohort that doesn’t produce anything close to an attractive return no matter how many of those same cohorts you pile on top of each other with more monthly acquisition.

The the link below takes you to a visual that is purely illustrative showing, randomly, an example of 140 sustainers acquired in a month at $300 cost to acquire, an average gift of $25 and Month 33 retention of this cohort at 33%.

http://agitator.thedonorvoice.com/wp-content/uploads/2019/09/Table-for-Jon.pdf

The exact falloff from month 1 to 13 will differ, and how that falloff occurs does matter but only at the margins. This further assumes a grossly unrealistic/optimistic 1 percentage point loss starting at month 12 and running to month 36 and then switching to an equally unrealistic, zero loss scenario, 100% retention of the remaining donors from Month 36-60. This gets you to a 5 year ROI of 1.07. That is both optimistic and atrocious.

To your other points, I understand the desire to parse out and distinguish between active cancellations and credit cards that don’t process and how/when/if they are subsequently re-tried/reprocessed, etc. And while those distinctions are worth digging into if we are interested in root cause analysis (and we should be), THE CHARITY NEEDS TO LOOK AT HOW MUCH MONEY AND HOW MANY DONORS ARE LEFT TO JUSTIFY THE SPEND, not rationalization and contrived figures that try to escape the inescapable fact that the ROI is atrocious and barely positive in only the best case, rosy glasses scenario (if 33% is your 13 month retention).

There are a host of reasons that door produces a higher retention rate. If those are replicable in street it simply isn’t happening in the aggregate. A theoretical stating it’s possible and/or contorted retention figures that ignore commonly held calculations for who, realistically, is going to be making payments into year two and beyond are whistling past the graveyard. There are certainly charities above 33% in the street. And I can only assume street (and door) retention differs by agency, which indicates there are worst/better/best approaches. But, my post is a commentary about the median and the sector and the dangers of not paying attention to the bottom line that matters most for the charity.

I wish you were right that somehow the Canadians, the Brits, the Europeans and the Australians had it all figured out when it comes to making money from F2F acquisition. That retention rates are, on average, higher in some of these markets ignores a host of factors, not least of which being ask amount. My purpose is to report that water is wet and that the expected retention of a donor, with all other things being equal, is lower at $25 a month than $10 a month – the latter is the Walmart model (low price, high volume) deployed in other parts of the world and it is neither right nor wrong, just a model. A model that can deliver higher retention, lower cost to acquire and yes, less income. The ROI is still, often times, highly unattractive. And of course those markets are grossly saturated with heavy supplier side economics that force costs up and yields down.

To your last comment, I can only imagine you are referring to either Amnesty or Greenpeace? I’d be happy to bring folks from one or both charities on for an interview to address your (misguided) comment that street failure came because they sacrificed fundraising for campaigning.

Roger

It’d be an odd F2F programme that has a retention rate of 33% in the first year, 67% in the second year and then 45% in the third year. You’d expect retention of this kind of donor to increase with tenure.

And I’m not sure why you think every donor would cancel before month 46? I think you’re assuming that a constant number of donors cancels each month, which is not what happens. (It’s more like a constant proportion of donors, though in fact, as I said, retention increases the longer someone’s been giving….)

Chris,

Many thanks for your comment.

Not sure where your 67% and 45% come from? I assumed a constant percentage loss, not number of donors. The retention rate as a percentage of donors giving in, say, month 36 vs. month 35 is high, really high.

And yes, the percentage of donors who keep giving in Year 3 compared to Year 2 is really high and it’s even higher for those giving in Year 4 as a percentage of those who were giving in Year 3.

Those percentages are alluring and deceiving because they ignore the raw counts. HAVING 100% RETNTION IN YEAR SIX OF MY YEAR FIVE DONORS HARDLY MATTERS IF I HAVE SO FEW DONORS LEFT IN YEAR FIVE.

This same thing is typically happening when showing donor satisfaction tracked over time if that trendline goes up dramatically. Yes, our Month 12 satisfaction rate is 93% and that is great compared to our 45% in Month 1 except that the only reason it went up so dramatically is that we lost all the dissatisfied donors.

Roger

Hi Roger.

You start with 1650 donors.

At the end of year 1 you have 545 left: 545/1650 = 33% retention in year 1.

At the end of year 2 you have 365 left. 364/545 67% retention in year 2.

At the end of year 3 you have 165 left: 165/364 = 45% retention during year 3.

I think your “constant percentage loss” is a constant percentage of the *original 1650 recruits*, i.e. you assume every month the charity loses 16.5 donors. Which is why you end up finding the charity has lost all these donors entirely by month 46.

This bears very relation to what actually happens, in my experience.

Chris

The attrition rates will, of course, vary from organization to organization. My goal with this exercise is simply to illustrate the importance of every F2F manager taking the time to determine how many paying donors remain at the end of each period.

Citing the retention rate as a mere percentage may be mask the reality for some organizations that the number of paying donors who remain may be insufficient to produce a significant ROI

Roger

I quite agree. And I’m guessing most of them do? After all the only reason you have to believe they don’t are your own calculations, based largely on figures you’ve made up, and which don’t bear any resemblance to what actually happens.

Hi Again Chis,

Absolutely.

I’m only recommending that folks employ arithmetic using their own numbers.

Unfortunately, I fear many managers don’t do that and listen too intently and naively to the numeric gobbledygook-gook of some vendors.

Some healthy skepticism and indecent analysis is food for the future of F2F that right now is too dependent on the “insights” of the vendors.

Roger

Roger, interesting post. I was never much of a F2F afficianado before but I’ve been able to look at some numbers for specific organizations and know that the numbers are much better, especially for those nonprofits that have been doing it for a while!

Many of them are looking at retention rates of in the 60s (which is the same as you’d get when you have a check monthly donor whom you need to send reminders to) and return of investment numbers of less than 2 years.

What’s important to remember is that F2F or Door fundraising have been around in other countries much longer. They’ve made it work because they have focused a lot more on monthly donor retention.

That is absolutely key and I didn’t see that as one your focus areas although I agree all of your areas are crucial.

It’s the back end that counts, that’s where you can make the numbers work and really keep those F2F acquired donors.

If you dig deeper in the Blackbaud study for specific organizations who have been running F2F or D2D in the US for a while, as mentioned their retention rates are much higher, especially if they can get donors to sign up using EFT/ACH.

It’s also important to note that the Blackbaud data is great, but the number of organizations as part of that study is relatively small.

There are many other orgs that are not part of the study that are showing better retention numbers.

They work at it, they test things, they make sure the systems work, they focus on it and most of those that have been doing these programs for a while are seeing return of investments of less than 2 years so the numbers do work for them otherwise they wouldn’t do it…

BUT make sure you always have your house in order before you look to go to the street, door, mall or event.

I recommend for any organization who is looking to grow their monthly donors to first focus on mail, email and phone and make sure all your systems work, the kinks have been worked out, you have thank you letters, thank you calls in place, and people focused on looking at all your numbers, retention, attrition, upgrades, downgrades, average gifts, payment type and more before you even think about looking at F2F or D2D.

There’s an organization founded a few years ago that’s a collaboration of most Professional Face to Face Fundraising agencies where organizations and their fundraising partners get together, share results, come up with ways to improve retention further. I recommend checking them out if you’re interested in looking to start F2F for your organization. https://www.pffaus.org/default.aspx?

Fundraisers are not here to squander money and F2F and/or D2D is just one way of growing your number of loyal donors, but you have to look at your overall monthly giving program and processes to ensure that they’re all focused on keeping those you bring in. It all works together!

cheers, Erica

Hi Erica,

Thanks for your comments. Indeed, that 33% retention rate is the median, which does mean, there are groups above this and in some cases, well above. It’s also true there are groups below this.

The Target data represents the best sample I could find and if it is reasonably representative then we don’t need a Census to reasonably assume there are groups not included that are above the 13 month figure and equally, groups below.

What is so important in your comments is your calling attention to the back-end, after-sale process that needs to be followed in onboarding, then providing monthly donors with meaningful and ongoing experiences and communications. It’s a that stage where so many F-2-F efforts fail.

As you say, “you have to look at your overall monthly giving programs and processes to ensure that they’re all focused on keeping those you bring in. It all works together.

Cheers,

Roger

Thanks for the views expressed in your article. It is an overall benefit to the industry to initiate these conversations. In my opinion, it is not helpful to do so in a way that fails to deliver a balanced view of the channel.

In addition to some conflicting calculations, there are several simplistic statements or assumptions that fail to account for the complexity of the topic and fail to highlight a holistic approach to moving the needle in a productive direction for non-profits that utilize face-to-face as a part of their acquisition mix.

If we really want to further the discussion in a way that will positively impact the sector, a balanced writing that highlights the success of organizations that are achieving greater than 50% retention in month 13 may be a better path forward. These organizations utilize a mix of Professional Fundraising Agencies that provide different remuneration, benefit and incentive packages, as well as utilize street. private sites, retail space and events as vehicles for success. I’m sure some would agree – it is not best (or practical) to put all of your fundraising eggs in one basket.

I believe we should be striving to a place of increasingly better performance. This cannot be done without discussion and collaboration. It cannot be done without having a full and accurate picture of the challenges we face. It cannot be done without acknowledging the many successful case studies as a result of non-profit and agency collaboration here in the U.S.

Are their programs that have delivered poor results – absolutely. And it is important to acknowledge those failures and ensure they are not duplicated. I am much more interested in discussing best practice, success and how to duplicate the acquisition and donor journey that is delivering impressive results for the many organizations that have got it right!

I’m not sure a reliable F2F program audit has ever or could ever be delivered with two micro take-aways and actually “fix” a program or market. I do not believe it is that simple and, as Erica aptly states, it fails to recognize the biggest driver of retention after acquisition – the donor experience.

What I know is that there is a large community of non-profits and agencies that have made the commitment to work collaboratively in the U.S. over the last five years to ensure we are working toward better program performance – always. If you are missing those conversations taking place at the PFFA sponsored Work Groups, you may be missing the boat.

Where is the “like” button? Well put, Sherry.

Thanks John. I was just digging into the 2018 Sustainer Benchmarking report that was presented to the PFFA this summer with an anonymized F2F break out. Per this F2F break out from the 2018 report, only 16 of the 35 organizations that participated in this group had F2F programs. Even more interesting is that four (4) of them has recently started up F2F programs in the last three (3) years and two (2) of those organizations had stopped and started their programs at least once in the last five (5) years. So that would leave ten(10) nonprofits that could put forth reliable results to indicate market performance. To say that the number of participants is a reliable sample size may be a stretch in that the slide posted (if from the 2018 TA report) seems to be a bit misleading without the context from the other slides from the same report. This year, there were more than 25 NPOs engaging in F2F in the U.S. if that helps to put the suggested sample size into perspective.

For the organizations included in the 2018 report, all medium and large sized programs delivered a median 13 month retention of 40% and 42%, respectively. It was smaller programs (< 10K) that had a median 13 month retention of 27%. I believe tests and start-up programs may be reasonable contributing factors.

Please note, the 13 month retention for F2F acquired sustainers for the same groups showed improvement, year-on year, in almost every sector. It remained flat for smaller organizations and made small improvements in medium and large programs over the last five years.

So again, there is still much front and back end retention improvement to be had but the omission of these additional facts (in addition to the other errors in calculations, etc.) would seem to sensationalize this article. I hope you find this additional context useful.

I thought the Target reports were confidential? Where does this data come from?

Hi Rae,

Target makes its aggregate data like these publicly available.

Target data that is organization specific is confidential and not shared.

Roger

Hi Roger! Fascinating article! I would be very interested to hear Daryl Upsall’s take on this blog. As you probably know, he’s been trumpeting the death of direct mail for years now, and pushing charities (including my clients) to switch from DM to F-2-F.

Would you consider asking him to write a rebuttal as a guest columnist? Could make for some interesting reading.

Richard

Hi Richard,

Good to hear from you. Been a long time.

I’m a big fan of Daryl’s and what he’s accomplished with F2F over the years. Of course I’d welcome his take on my concerns about what seems to be happening in the US market. Or any other market for that matter.

Today’s post isn’t about Direct Mail vs F2F. Rather it’s about what F2F managers should be focusing on when it comes to maximizing their investment. Daryl has decades of successful experience from which Agitator readers can benefit and I’d welcome his sharing.

Thank you for the suggestion.

Roger

Fascinating read. Interested to read the next series of articles.

As a provider who has driven acquisition primarily through street for the last 16 years in the United States, the industry has accomplished quite a bit. We have seen many programs reach over 50% at month 13, yes on the street too. Is that easy to accomplish? No, however, working in tandem with all stake holders has show it is possible to exceed those figures. It requires teamwork and partnerships that work together to improve all aspects from acquisition to donor experience.

While the US market may still be in the “infancy” stage, there is a strong commitment from all to exceed expectations and deliver a strong ROI. I would be interested to hear directly from organizations who are seeing strong results from F2F. This one example doesn’t reflect the industry.

We are fortunate in the USA to have talent from all over the world to share what has worked and what has not worked in multiple countries. The collaboration in the states is strong from competitive agencies, which is rare to see. We all share a belief that we can work together as Professional Fundraising Agencies, NPOs, Consultants, DM and TM agencies to create an industry we are proud to serve.

We would love for you to join us for a professional working group and see firsthand the results the US market is achieving.

Thanks Mike ,

Delighted to get your take on F2F activity in the US

Collaboration and information sharing are important pathways to success and growth.

Would be delighted to learn more from your group.

Roger

Hi Roger,

There are certainly some important questions to be asked about the practices of many F2F operations that fail to reach the quality standards that their NGO clients (and the donors supporting them) expect and deserve. However, the financial and contextual analysis in this post is misleading and indicative of the lack of understanding of this channel (even within the sector and by experienced fundraisers) that creates an environment in which rogue F2F agencies can survive.

While it’s clear that any F2F campaign that results in a 12-month retention rate of 33% is fundamentally flawed (and worse than any within my 20 years of experience), the figures outlined under the sub-heading ‘First, Some Simple Arithmetic’ are inaccurate and undermine the credibility of the analysis. The problem here is that the income figures are based upon the assumption that none of the 67% of donors who have attrited generated any income for the charity before they cancelled their donations.

In practice, we know that this is not likely to be true, which has an important impact on ROI calculations. The pattern described by Chris Keating is pretty much universal, in that most F2F donors who cancel tend to do so in the initial months, with the donor base becoming increasingly stable over time. This leads to an income scenario more like the one below, based upon your assumptions of 1650 donors recruited at an average donation of $25/month (apologies for any formatting issues):

Month Donors Attrition % Retention % Monthly $ Annual $

1 1650 0% 100% $41,250.00 $41,250.00

2 1320 20% 80% $33,000.00 $74,250.00

3 1096 17% 83% $27,390.00 $101,640.00

4 942 14% 86% $23,555.40 $125,195.40

5 839 11% 89% $20,964.31 $146,159.71

6 755 10% 90% $18,867.88 $165,027.58

7 694 8% 92% $17,358.45 $182,386.03

8 646 7% 93% $16,143.35 $198,529.38

9 607 6% 94% $15,174.75 $213,704.13

10 577 5% 95% $14,416.02 $228,120.15

11 559 3% 97% $13,983.53 $242,103.68

12 548 2% 98% $13,703.86 $255,807.55

Annual retention rates: Donors 33%

Revenue 52%

Annual attrition rates Donors 67%

Revenue 48%

While these results are still well below the returns that I have seen from the F2F campaigns that I have managed, this clearly paints a very different picture from your calculations that projected an income of $163,500.00 over the same period.

Furthermore, in addition to the standard clause in most F2F contracts that guarantees the replacement of any ‘no-shows’ (ie. potential donors who fail to complete their first payment), there are usually also clawback clauses that offer charities a partial refund for donors who attrite in the first 1-3 months. Not only do these terms further improve the ROI, but they also provide suppliers with a strong financial incentive to improve the quality of the donors that they recruit. Failing to mention them in this context is a missed opportunity to raise awareness of their importance as part of a strong agreement with F2F suppliers and of their role in lifting standards across the industry.

Unfortunately, this type of miscalculation is quite common in the analysis of F2F by people who lack experience in the channel. Rather than accepting the simplistic and somewhat harsh conclusion that many experienced and well-intentioned fundraisers can’t or won’t count, I would rather believe that this is due to them applying the logic of single-gift campaigns to a monthly context without making the appropriate adjustments.

Best, David

Hi Roger,

Well it seems you have hit your KPI’s around agitation! It hurts to see such an unbalanced article written by a respected figure, the worrying reason is many (or at least those who don’t really understand F2F) will take your word as gospel. In all fairness, historically, there are some ugly results, even now but that can be said for all fundraising channels.

It is possibly fair to say the market has been slow to develop but I would like to argue the market is changing rapidly for the better. I am also aware of operations reaching 55 – 65%+ 12m retention at large volume, in the US right now.

You cannot simply disregard a whole F2F sub-channel (street). What about the fundraising halo effect from having hundreds of passionate charity ambassadors speaking to your public, well branded in busy street locations or the lovely man that now plans to leave a $1m legacy gift, all inspired by a conversation with a F2F fundraiser in the street (you won’t see this in the F2F budget). What about having a diverse portfolio, spreading risk, improving donor profiling and audience segmentation? We should be encouraging people to speak to the right people with the right product in the right place and advances in technology and product development means we can now provide more options for donor engagement than ever before. I know of 3 major donors in the past 12months that signed up to a street canvasser. Highly unlikely we would have met these donors if we weren’t doing street but D2D (or possibly any other fundraising channel) let alone get access to their driveway. Also, what about event, private site or business to business via F2F teams?. It all works if you do it right.

There is a growing understanding of regular giving in a market that has been very cash focused. People now get the need for detailed and frequent data insights, a nurturing donor journey and many are developing training and engagement calendars for their F2F fundraisers. It seems, for the most part F2F fundraisers are being engaged better and paid more fairly. The great thing about F2F is you can change things fast when needed.

The key to success is an awesome back end, an amazing donor journey, a solid F2F team inspired (engaged, supported and fairly paid) with a product or products that appeal to the masses and engage the individual. Its paramount that we ALL do our best to facilitate this and share our learnings as F2F (Street, D2D, Event, Private sites, B2B) can and does work in even the toughest markets, proving good money to great causes, when you get it right.

Cheers,

Danny

Hi Roger,

Well it seems you have hit your KPI’s around agitation! It hurts to see such an unbalanced article written by a respected figure, the worrying reason is many (or at least those who don’t really understand F2F) will take your word as gospel. In all fairness, historically, there are some ugly results, even now but that can be said for all channels.

It is possibly fair to say the market has been slow to develop but I would like to argue the market is changing rapidly for the better. I am also aware of operations reaching 55 – 65%+ 12m retention at large volume, in the US right now.

You cannot simply disregard a whole F2F sub-channel (street). What about the fundraising halo effect from having hundreds of passionate charity ambassadors speaking to your public, well branded in busy street locations or the lovely man that now plans to leave a $1m legacy gift, all inspired by a conversation with a F2F fundraiser in the street (you won’t see this in the F2F budget). What about having a diverse portfolio, spreading risk, improving donor profiling and audience segmentation? We should be encouraging people to speak to the right people with the right product in the right place and advances in technology and product development means we can now provide more options for donor engagement than ever before. I know of 3 major donors in the past 12months that signed up to a street canvasser. Highly unlikely we would have met these donors if we weren’t doing street but D2D (or possibly any other fundraising channel) let alone get access to their driveway. Also, what about event, private site or business to business via F2F teams?. It all works if you do it right.

There is a growing understanding of regular giving in a market that has been very cash focused. People now get the need for detailed and frequent data insights, a nurturing donor journey and many are developing training and engagement calendars for their F2F fundraisers. It seems, for the most part F2F fundraisers are being engaged better and paid more fairly. The great thing about F2F is you can change things fast when needed.

The key to success is an awesome back end, an amazing donor journey, a solid F2F team inspired (engaged, supported and fairly paid) with a product or products that appeal to the masses and engage the individual. Its paramount that we ALL do our best to facilitate this and share our learnings as F2F (Street, D2D, Event, Private sites, B2B) can and does work in even the toughest markets when you get it right.

Cheers,

Danny

Hi Danny,

Thanks for your thoughtful response and the issues you raise.

As for KPIs we’ve certainly hit a nerve and, of course, we’ll continue to write on this topic not only to keep it alive, but to clean up some admitted errors in the post and to also restate important points that seem to have gotten lost.

As far as the Agitator’s editorial position is concerned I want to emphasize that for the 14 years of its history we have neither sought to write “fair and balanced”, nor do we strive to distort.

This is an editorial/opinion blog with the mission of constantly pressing– occasionally to the point of high agitation– a sector to which we’ve devoted various lifetimes. A sector that is dying a slow death if all the sector benchmarking is to be believed. We believe that the model of volume (“mail more, make more”, “ask more, make more”) is the master that permeates everything, including F2F– and not just in the US.

Our post on F2F in the US is based on median data and from a very large sample size. Median means half of the sample is at that figure (33% for street in this case) or worse. To suggest we unnecessarily slammed the sector when reporting on reality for half of the world is crazy. We’ve touted success many times and will continue to do so.

We’ll certainly revisit the math and calculations but the headline/takeaway from the post remains the same – median street retention is delivering a lousy five-year return. Half of the charities in this large sample face this unpleasant reality. This is irrefutable.

In the other half there are some groups doing really well and also, some that are hovering way too close to 33%. The larger point in all of this is that street retention is much, much lower than door retention and the question that should be raised—assuming as I do that the sector really cares about delivering and optimizing net revenue from its marketing spend– is why, in this massive sample size, roughly 97% of the acquisition being done in the street vs. door?

All the comments about needing to ‘diversify the portfolio’ ring hollow, since those comments were meant to suggest having some street in your “portfolio” is a good thing. It’s almost all street.

And in the US it isn’t as if door to door is completely saturated and folks needed to shift to door to address the diminishing returns. It is wide open spaces where canvassing at the door is concerned

So, what explains why a channel that is experiencing high growth in number of vendors, in number of charities spending in the channel and the amount of spend going up, is so crazily skewed to a mode (street) that delivers a far worse return?

The answer: Volume is the Master, still. You do get more volume (not necessarily better conversion rates) in street.

You and I, and all of us here, couldn’t agree more that donor journey is the key to retention, regardless of channel. We’ve written extensively on that topic and would argue nobody is more expert on this subject than the folks writing and supporting the Agitator.

Again, thanks for your comments and stay tuned, ‘cause there’s more to come.

Cheers,

Roger

Thanks Roger,

This is all very interesting and reflects the stage the US market (not the world) is in. F2F needs to offer more, I agree. More sub-channels, more products, more focus on the fundraiser and their wellbeing, more investment in training and engagement (on both sides of the fence) with the org they represent not to mention more focus on the donor experience, better regulation and better targeted donor profiling.

You have highlighted some bad apples and that needs to be done, well done. I also agree, attrition at the levels you report is shocking and unacceptable.

Glad to hear you will revisit the numbers as these don’t stack up.

Finally, I would argue that the title should be changed to ‘Are fundraising directors (or individual giving managers) squandering millions in F2F’ as, they are the ones in control of the budget. They are also the ones overseeing all of this, they are responsible for hiring experienced or often inexperienced Individuals to oversee multimillion $ investments in a channel they don’t understand. It is them who oversees the ongoing comms and they have the power to direct their investment to ensure they are getting the best returns.

But, let’s not get caught up in a blame game. As someone wise once said, those who ignore history are doomed to wear it. We have enough global knowledge to tap into. We just need to make sure we do.

Onwards and upward!

Danny

Hi Roger –

Thanks for starting this conversation. I secured permission to use client specific data in order to add my comments to the dialogue.

As a consultant focused on sustainer programs, I am actively supporting four national canvassing programs in the U.S. I trust that your viewpoint is based on the data you have available. I will simply share that with proper management, F2F can be wildly successful and can beat the numbers you are sharing which in my opinion do not reflect a mature or optimized channel.

First a couple of thoughts on the calculations you shared:

One of the first items I review in any canvassing program is the pricing model, impact of the clawback arrangement(s), and data reporting accuracy supporting those contracts. As David mentioned earlier, the clawback calculation is critical to the analysis and comparison of net CPD and ROI by vendor, by canvassing type, etc. To be specific, $300 is higher than the net CPD my clients pay for a $25 gift – which of course directly impacts the breakeven point and ROI.

Additionally, if your data is looking at 100% of donor names passed from the vendors and not just the sustainers who successfully made a recurring payment and were actually billed by the vendors – in my opinion, this isn’t a true ROI calculation because the analysis should be based on the actual investment. Many vendors do not bill for certain donors up front – donors that cancel within a certain time frame, donors that do not pass quality checks, donors that are 1x donors, etc. Including these donors that are not part of the NGO investment could be dropping this retention calculation a few points. I have seen this be an issue a number of times. Given that the industry wide data I’ve run and seen in the last few years is closer to ~40% of payers at month 12, I wonder if this is something to look at here as well. I’m not talking about the month 2 & 3 clawback post billing here – just using a clean starting point for month 1 to ensure we’re not under reporting retention by using the wrong denominator.

And a success story in counterpoint to your example….

One of my clients launched canvassing just last summer and we are seeing incredible results. Client & vendor to remain nameless per request.

2,700 Sustainers Acquired in year 1

Average Sustainer Gift = $30

Month 2 = 82%

Month 3 = 72%

Month 12 = 40%+ for months fully exposed

W/ Clawback = Net CPD $289 (note a lower CPD + higher gift than your example)

Year 1 VPD = $220

Based on an a conservative average of 9 payments annually at $30 per payment to project year 2+ revenue for the donors still on file after 12 months in order to account for additional attrition, this organization is breaking even in under 24 months.

We have done three critical things together on this program:

1) Built out the full sustainer donor journey & launched any missing components as they were launching F2F in order to maximize their investment.

2) Tested higher gift levels and monitored retention. They are not experiencing a trade-off between higher gift and lower retention at this point.

3) Maximized their execution of the clawback reporting to ensure their Net CPD is accurate and ROI is maximized.

This is just one example, of course, but all of my clients push the levers on Gift vs Cost vs Retention to maximize this channel and they are each currently breaking even between 18-36 months on canvassing. Given comparative breakeven points and ROI on 1x donors across channels, the LTV comparison of sustainers vs 1x donors, and sheer scalability of F2F – this channel continues to be a smart investment for my clients whether in street, door, or private site.

As for the issue of door vs non-door canvassing, there are pros and cons to each type of canvassing. My clients are currently doing <10% door, and while a couple are actively looking at the option to do more … the market capacity available and complaint / perception management of that vehicle of F2F presents challenges to the scalability. I am a proponent of having a mix of all types of canvassing to balance the drive for volume and performance.

Cheers!

Kelly England