Does Biden/Trump Winning 2024 Lower Charitable Giving?

The answer is an emphatic yes and no.

The classic case of crowding out is government spending on social ills that lowers the need for individuals to give. Empirical evidence for this effect has been mixed.

But, what if the effect is more complicated than that and what if it has nothing to do with actual government spending on societal welfare?

It turns out there is a large effect on charitable giving depending on who the President is and whether you’re politically aligned with that person or not.

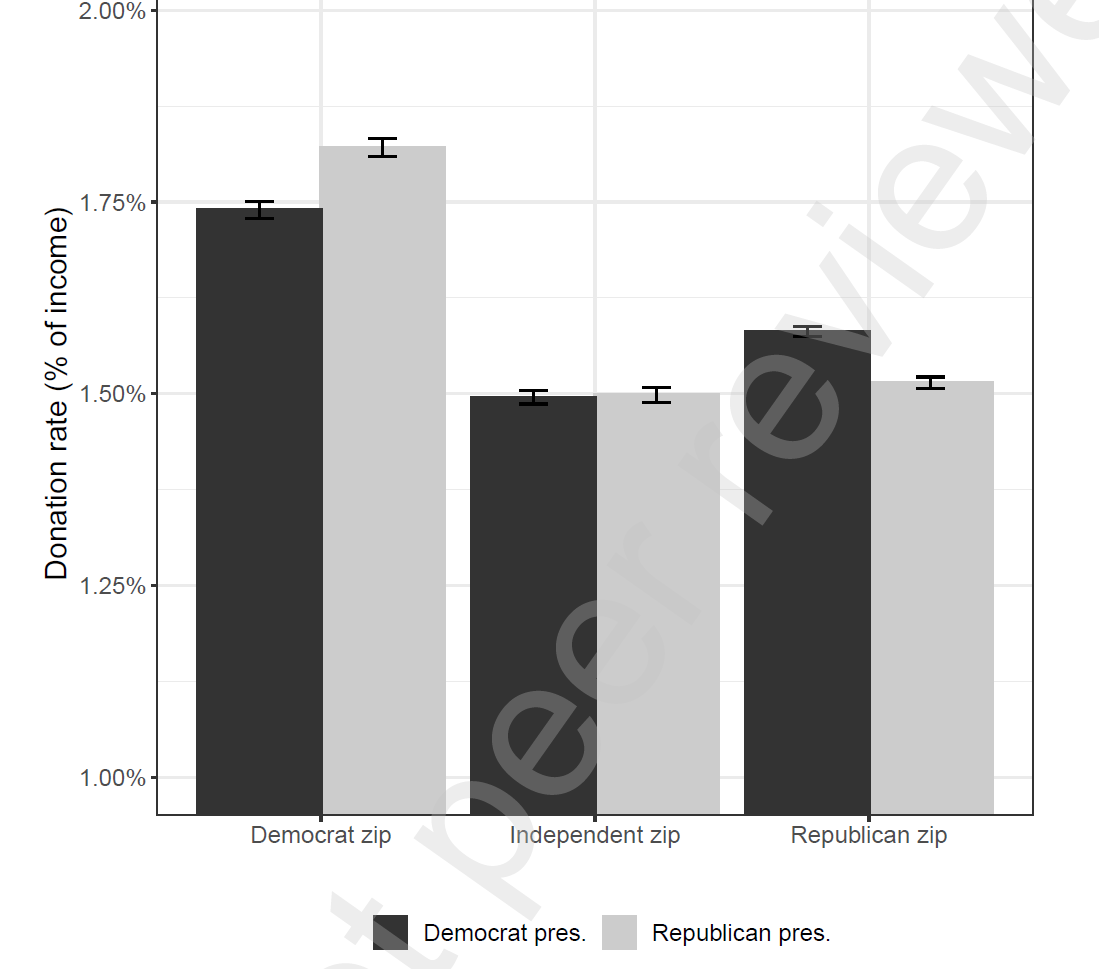

Democrats gave less to charity when a Democrat was President. Republicans did the same with an R in the White House. This pattern is robust and holds across many cycles.

And the more partisan the zip code, the stronger the effect. For example, San Francisco and Eastern Montana zip codes have an even bigger decline in charitable giving when the President is Democrat or Republican, respectively.

And the effect size is big. This analysis is hot off the press in pre-print, July 2022 and conducted by researchers (Teeselink and Melios) at London School of Economics.

The researchers used IRS charitable giving by zip code between 2002 and 2018. They combined this data with Presidential vote data, also broken down geographically.

They coded a zip code as R or D if the respective party got at least 50% vote share between 2000 and 2016 and Independent if not. They also re-ran the analysis at 60% requirement to tighten up the partisanship definition.

The table tells the story but the details on effect size from their regression analysis are stunningly large. Republican and Democrat zip codes give 4.6% and 4.4% less to charitable organizations during own-party presidencies.

This reduction in giving only goes up if you increase the partisan definition to 60% vote share.

The researchers covered all their bases, accounting for actual government grant giving and finding no effect on more dollars flowing to D or R zips with a D or R in the White House.

Further, they controlled for the tax code changes in 2017 that made it less beneficial to itemize and the effect still exists and the size is largely unchanged.

Why is this happening? The researchers relied on the annual General Social Survey (GSS) that asks people whether it should be a role of government to help solve social problems.

The reason charitable giving goes down is because partisans change their belief about the role of government contingent on whether their party is in power. During other-party rule they turn to private entities – i.e. charities.

It’s worth noting that there is a difference in Republican and Democrat behavior. The R reduction comes mostly from fewer R’s giving. The D reduction comes more from those same D’s giving less.

If your supporters are mostly Democrat/Republican, be careful what you wish for in 2024… If you’ve got a mix, it’ll all come out in the wash.

Kevin