The Cheap Money Paradox

The pandemic should cause us all to re-think many fundraising “norms” –notably the value of money and what it means not only to donors but to nonprofits as well.

In order to stimulate a Covid-stricken economy the U.S. Federal Reserve (and central banks elsewhere) has dramatically lowered interest rates and promised to keep them low for at least the next two years. This move toward low, low interest rates create a paradox to which every fundraiser should be alert.

On the One Hand…

… the giving of some donors –particularly those 60 years old and above–is likely to be negatively affected. With today’s money market funds currently paying an annual interest rate of 0.05% this means $5,000 in savings will yield an yearly sum of only $2.50. Certificates of Deposit do a bit better with a one-year CD currently paying 0.85%. That a whopping $42.50 on that $5000 investment

Of course donors have other investments, but I call the current interest rate to your attention because the median American donor is 63 and many folks around this age and above are beginning to live on fixed incomes. Fixed incomes that will, because of the low interest rates, diminish whether invested in a CD, bond or other fixed investment.

Be particularly alert to your monthly or sustaining donors. In the 2007-2008 Great Recession attrition and/or declining revenue within this group was substantial and in no small part due to the lower interest rates donors received on their savings. Now is the time to be in touch to let your monthly donors know the good work their regular giving is achieving. Now is also the time to be eagle-eyed on cancellations and delinquencies and have a plant to reach out and offer to pause or renegotiate their giving.

Just what the effect of low interest is on other classes of donors has yet to be seen. Some, who are benefitting from cheap money may have borrowed and invested in the stock market and done quite well in the pandemic. Or, their Donor Advised Funds may have done well so far. In either case they may reflect their good fortune in their generosity. Others, more oriented toward fixed income, may be far more cautious.

We’re likely to begin seeing a pattern as we get into the year-end giving season and we’ll keep you posted on that.

On the other hand…

…low interest rates (cheap money) represent a historic opportunity for nonprofits. If ever there was a time to substantially boost acquisition investment and increase spend on donor care and improving donor experience now is the moment. The financially wise nonprofit will seize this opportunity for both new donor growth and to invest in hiking retention rates.

Of course, it’s highly unlikely that most boards, CEOs or even CFOs will think this way. Conventional wisdom, as best as I can tell is that in the midst of this uncertainty and economic recession “we should pull back”…”husband our resources”…”not be aggressive at a time like this”….and a thousand other cautionary excuses

The conventional mindset of most boards and many CFOs is flee to the “safety” of the most “solid”, “risk-free” l investments like CDs, bonds and other U.S. Treasury instruments. You know, “protect what we have.”

Sadly, there are precious few organizations that ever bother to compare the returns from their “safe” investments to the returns the organization gets from its own fundraising.

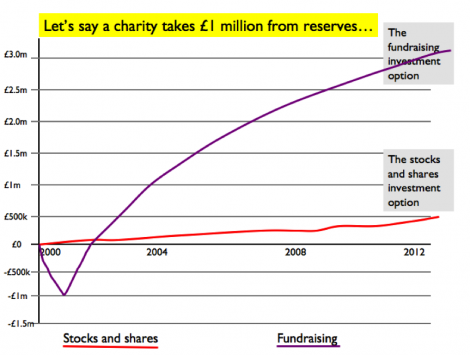

In a study of 32 charities undertaken as the sector emerged from the Great Recession British fundraising strategist Giles Pegram CBE set out to do an analysis of standard, safe investment returns compared to the yield from their fundraising activities.

Giles assumed a scenario where, instead of investing in the usual stocks and bonds, the charities would take £1 million from reserves and invest in their own fundraising programs.

As you can see from the chart below the average return on the fundraising investment for these charities was vastly more impressive than the return on conventional investments.

I’ll take a 3 to 1 return on investment over a 0.05 to 1 return on investment any day. I bet your board and CEO would too. (Once they get over their embarrassment.)

And I know for certain your donors will be a lot happier knowing you’re using some of their money by investing wisely — and with quite high returns — in building the future of your organization.

Oh yes, I can already hear the naysayers in the C suites and boardrooms. “But, it’s risky and unconventional.”

Nonsense. You’ve already tested and know near-certain results of stable, proven fundraising programs — acquisition, monthly giving, whatever — you know precisely when the funds can be paid back and how much you’ll make on the investment. Can’t say that about many investments in banks, bond or in the stock markets these days.

So why not do a comparison for the CEO and Board. Show them what the current return is on the invested reserve or endowment funds. Then show them what the return is on your fundraising.

Then….show them just what a better use putting some of the endowment –or taking a historically low interest loan–could do for your organization’s future.

If you don’t get a raise, you should definitely update your resume because you’re dealing with folks who either don’t understand the value of money or don’t care.

We gave Giles an Agitator Raise when he shined the spotlight as we were coming out of the Great Recession. Now, in light of the opportunities presented by low-interest, cheap money we’re sending him another raise.

Is your organization putting its reserve funds to work or seizing the opportunity of cheap, low-interest loans in boosting acquisition and donor retentiongrowing its future?

Roger

P.S. In case you’re not sure how to go about calculating the comparisons between what the board investment committee is getting and what your fundraising program returns, we’ve prepared an AGITATOR GUIDE TO CALCULATING INVESTMENTS.

Bravo Roger! Today’s column concisely distills a lifetime of frustration trying to convince non-profit Boards and C-suite leadership to do the right thing for their organizations, employees, donors and their bottom line. Once more into the breech! Here’s hoping your wise words fall on receptive ears.

Cheers to you,

Charlie

Boy, do I wish that the term ROI was not so foreign to so many board members of nonprofits. Even successful business people seem to forget that the NPO can be run somewhat like their commercial business.

Roger, as usual thanks for pulling the details together so nicely!