Time for a Money Revolution in the Board Room

Conventional wisdom in nonprofit board rooms, as best as I can tell, is that “in the midst of these uncertain political and economic times we should pull back”…”husband our resources”…”not be aggressive at a time like this”….and a thousand other cautionary excuses.

Frankly, whether in good times or bad that’s usually the case because the accepted mindset of most boards and many CEOs and CFOs is to flee to the “safety” of the most “solid”, “risk-free” l investments like CDs, bonds, and other government treasury instruments. You know, “protect what we have.”

Sadly, there are precious few organizations that ever bother to compare the returns from their “safe” investments to the returns the organization gets from its own fundraising.

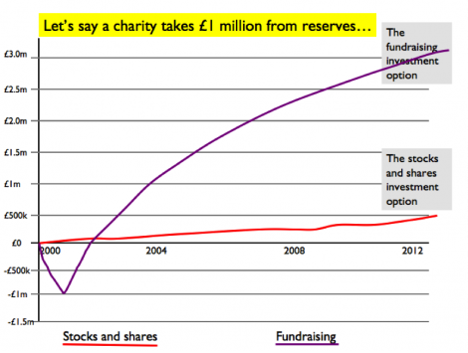

In a study of 32 charities undertaken as the sector emerged from the Great Recession British fundraising strategist Giles Pegram CBE set out to do an analysis of standard, safe investment returns compared to the yield from their fundraising activities.

As you can see from the chart below the average return on the fundraising investment for these charities was vastly more impressive than the return on conventional investments.

I’ll take a 3 to 1 return on investment over a 0.05 to 1 return on investment any day. I bet your board and CEO would too. (Once they get over their embarrassment.)

We need to be asking, over and over, “Why is the nonprofit sector so incredibly hamstrung financially?” Why are there few financial players and market makers in the nonprofit sector that could provide more financing options to generate growth and scale?

Why is a nonprofit’s usual and, generally, only source of money for growth limited to either ‘stealing’ from operating funds, or some rich guy or gal committed to funding the growth of a favorite cause? Crazy.

Of course, it doesn’t have to be that way. And for some foresighted, gutsy, and innovative fundraisers it isn’t that way.

Enter one of our favorite innovators – Franceso (Frankie) Ambrogetti who for 25 years has been mobilizing resources in ways that challenge the status quo. Currently, Frankie serves as the Principal Adviser of Innovative and Alternative Finance for Children at UNICEF.

I caught up with Frankie the other day to congratulate him on UNICEF/The World Bank having received the prestigious “Deal of the Year” award given by the International Law Review Europe in recognition of a breakthrough innovation a sustainable bond that gives UNICEP access to substantial access ($50 million) to capital to grow its global fundraising.

Many readers will recognize Frankie for his two recent books on the importance of emotion in engaging and retaining donors —Hooked on a Feeling and Emotionraising— but what many don’t know is that he started his career with the World Bank and gained an understanding of social finance before moving on to the UN to serve UN AIDS and now UNICEF.

Consequently, Frankie thinks like both a banker and a fundraiser. “Philanthropy is great, but it just doesn’t grow the pie”, he told me. “The sector in the US and Europe has had the same proportionate share of global income for the past 20 or 30 years. The sector improves its income only marginally, in small increments. If we’re going to meet the crying needs of the world, we have to find the investments to tap into billions and billions more in support.”

His goal for UNICEF? “To engage 100 million people to give their money, voice, and time to make the world a better place for children. “

With that goal in mind, Frankie has turned UNICEF’s attention to emerging markets (“Like Thailand and India” because that’s where the growth is.”) with the aim of raising between $400 and $500 million in Regular (Monthly) Giving over the next 5 years.

And that’s where the “Deal of the Year” sustainable bond comes in. This $50 million bond is designed to provide the investment required to mount Regular Giving campaigns in emerging market around the globe. The acquisition and donor development campaigns will be conducted thru face-to-face, digitally and with emphasis on retention.

Here, according to Frankie, is how the bond is structured and what he projects to be the five-year result:

- The bond, purchased by a group of private investors, is of the “nonrecourse” variety. Meaning, none of UNICEF’s assets are pledged against it. The investors are banking on the fact that the money raised will pay the interest (1.25% per year) and return the invested principal.

- The investors are assuming very little risk given the 10 years of UNICEF fundraising data presented to them. But if worse comes to worse the investors, not UNICEF, are out their money.

- Frankie is projecting a 4:1 return on the investment and so far, early into its first year the effort has already yielded $120 million more than was borrowed.

Of course, not every organization is a UNICEF, but every organization isn’t faced with the needs and challenges of a UNICEF. What is important beyond the size of this particular bond is that it’s way past time for more and more nonprofits to think of alternative sources of investment if they want to grow. Afterall, if it works for a massive organization like UNICEF the approach will work equally well for smaller organizations with a track record.

Time to apply a “revolutionary” idea: The days when fundraisers with proven, productive programs should have to go to their board and beg for a few more cents when capital to finance proper growth is readily available. After all, as Frankie reminded me, there’s no for-profit company on this planet that grows only on the profit from the goods it sells.

Roger

P.S. I asked Frankie what he was thinking about for his next lap in innovative financing. He indicated that fundraising in areas prone to cyclones and other massive natural disasters posed additional risk. So, he’s now working on a deal with re-insurance companies to underwrite against these disasters and pay for income projected to be raised were it not for the disaster.

OMG, Roger and Frankie! I had no idea … NO idea. Fabulous forward thinking.

dear Tom….there is no other way to break this old machine and fulfill the drema we pormised to achieve

Roger, Good morning my friend. Your message today on resource development for nonprofits is timely. In fact my institute is focusing on it rather than just traditional “fundraising”. As I have shared a study commenced int 2008 comparing a for profit industry (Recreation Industry) which generated the same level of revenue $350 Billion as philanthropy at the time same $350 billion. I chose them because they like philanthropy are dependent on the “discretionary dollar” meaning earnings come from finance over basic needs of Food Shelter Clothing,etc. Our study revealed the recreation industry altered their marketing, product line, and took advantage of an increase of women and families who were featured in athletics, running, active family program on land, sea and air. While philanthropy continued its traditional programs based on a “beggar strategy”. In 2021, recreation had increased Revenues to $1.4 trillion or a 300% increase while philanthropy was essentially stalled at an increase of about 20% to $440 Billion.

Your article of course goes into much needed detail, and your illustrations are just the top of the icebergs of opportunity, but essential. I thought an actual illustration in the US might be of interest.

Thank you Bob,

You and your Insitute have indeed shed important light on this issue.

In terms of US examples, f

ortunately, over the past few years more and more social innovators, financiers and philanthropists have been moving in the direction of exploring the use of variations of the financial instruments and approaches that help drive much of the private sector.

Tina Rosenberg, author of Join the Club: How peer pressure can save the world In a recent New York Times piece offers a fascinating insight into an increasingly popular financing instrument for nonprofits –the Social Innovation Bond.

Tina’s NYT piece, Issuing Bonds to Invest in People tells the story of the organization Social Finance and its Pay for Success programs that uses innovative financing to improve the lives of people through the activities of nonprofits working with local governments and universities.

[ https://www.nytimes.com/2018/03/06/opinion/social-projects-investing-bonds.html?action=click&pgtype=Homepage&clickSource=story-heading&module=opinion-c-col-right-region®ion=opinion-c-col-right-region&WT.nav=opinion-c-col-right-region ]

As an example, Tina cites a Connecticut drug program aimed at preventing family disintegration.

She explains, “The bond works like this: A group of private and philanthropic investors, led by the European bank BNP Paribas, put up $11.2 million. The agency set specific goals: Clients should have more clean drug screens, fewer reports of child mistreatment and fewer foster care placements, compared to a control group. The better clients do, the better investors do.

“If the program fails to meet its targets (the University of Connecticut Health Center will evaluate it), investors can lose all their money. If it succeeds, Connecticut repays the investors, with interest. The state will also have saved money, by reducing the number of foster care placements.”

According to Tina, “The idea of social innovation also known as social impact investing is catching on. There are now 108 such bonds, in 24 countries. The United States has 20, leveraging $211 million in investment capital, and at least 50 more are on the way.” She goes on to report…

“…. These bonds fund programs to reduce Oklahoma’s population of women in prison, help low-income mothers to have healthy pregnancies in South Carolina, teach refugees and immigrants English and job skills in Boston, house the homeless in Denver, and reduce storm water runoff in the District of Columbia. There’s a Forest Resilience Bond underway that seeks to finance desperately needed wildfire prevention.”

(You can read more about these performance-based, “pay for success” impact investing programs, how they’re financed, and how they’re evaluated on the Social Finance website.

https://socialfinance.org/what-is-pfs/)

[…] Source_link […]

Thank you for this study. This is an ongoing conversation I have with nonprofit boards… how about instead of cutting your staff or trying to run that social change education effort, you shake out a substantial enough piece of your investments to finance significant fund development or a social marketing campaign with real teeth. Sometimes they take my advice, more times than not they don’t. This helps substantially.

As for social impact bonds, I think the jury is still way out on this. I’m not finding studies of the results of these programs on the Social Finance website, just descriptions of the projects and how they might be measured (perhaps, Roger, you could share the outcome studies) The problem I see is accounting for the savings government realizes because cost savings are usually dispersed over multiple departments … often not even in the same branch of government. For example, investing in housing and support for the unhoused does save money and lives — but the money it saves is spread among emergency services (municipal), costly emergency room visits (hospitals and gov’t), partly in police (municipal), partly in shelter services (state, nonprofit), sometimes in health care (though a VA study from many years ago, as reported to me, showed that the impact of access to health care is more health care spending because you go from a person not spending any money on health care to someone who now is). How do you track that? Never mind that costs overall keep rising, so where is the surplus to pay back the social impact bond?

But I love the UNICEF example. Because return can actually be demonstrated.

That is fantastic. I can remember 20 years ago trying to persuade people to create an acquisition investment fund that could be used as capital for acquiring regular givers in a similar type of arrangement. Sadly, it was too foreign a concept. However one charity – Cancer Council NSW -saw the potential and made the bold decision to dip into its reserves to fund acquisition of regular givers. It was enormously successful. We need more bold thinking of this type.

[…] Heck, really rich people and those in finance don’t even call it debt, they call it leverage. Leverage is good. It’s gets you where you want to go much, much faster. This is what UNICEF did that Roger wrote about on Wednesday. […]

[…] Heck, really rich people and those in finance don’t even call it debt, they call it leverage. Leverage is good. It’s gets you where you want to go much, much faster. This is what UNICEF did that Roger wrote about on Wednesday. […]

[…] Heck, really rich people and those in finance don’t even call it debt, they call it leverage. Leverage is good. It’s gets you where you want to go much, much faster. This is what UNICEF did that Roger wrote about on Wednesday. […]