WANTED: Fundraisers and Consultants Who Can Count

Regular readers will note that we’ve been devoting a good deal of coverage lately to the use of AI, particularly as it relates to creative and copywriting. Today, we’re hitting “pause” on AI and returning to 8th grade arithmetic.

You know, the type of intelligence that enables you to work with numbers in everyday life. The stuff you can apply simply using a pencil and the back of an envelope. No apps or AI needed.

Generally, this post is aimed at any fundraiser who deals with acquisition. More specifically those responsible for the acquisition of monthly donors using Face-2-Face, telemarketing, or direct mail. But also, those who work with digital generally.

It’s time to re-visit some grade school arithmetic for several reasons:

- Today, millions and millions of dollars are now being spent—much of it mis-spent– on the acquisition of monthly donors. Of the acquisition channels F-2-F has become dominate.

- On top of this a new wave of European F-2-F agencies are entering the North American Market. Like clear-cut logging companies or strip miners having exhausted donor bases in Europe they’re searching for new forests, new mountains to strip.

- Sadly, both trends are occurring in a market where nonprofit acquisition managers and too often their consultants focus on immediate costs and returns without realizing the horrible intermediate and long-term damage their shortsightedness produces.

Basic Quiz & Fundamental Lessons for Every Fundraiser and Consultant Concerned With Monthly Acquisition

- Q. Which donor do you want? One that cost $100 cost to acquire or $125?Knee-jerk is $100. But the only appropriate answer is ‘it depends’.

A.Knee-jerk is $100. But the only appropriate answer is ‘it depends’

- Q. Which donor acquisition source do you want. One that breaks-even at 12 months or break-even at 12? A.Knee-jerk answer is they are same. Appropriate answer is, ‘it depends’

- Lesson #1.Stop looking at only the first, most immediate figure. It’s like staking you future on the first crack in sidewalk when there’s a whole city block of sidewalk ahead.

- Lesson # 1a. Using this kind of break-even measure is like answering the question, “How long is the piece of string?” Can’t be done accurately without seeing the full string.

- Lesson #2. Unless you’re taking donor retention into account you’re probably cheating the organization’s future in a severe and reckless manner.

- Lesson # 3. And even more costly than poor retention is the high cost of quitting or attrition. Remember, the pile of newly acquired sustainers or monthly donors who quit includes not only all the quitters you measure but all the pre-quitters we created – those exposed enough to brand to say “no” before saying “yes’.

A Nutshell Illustration

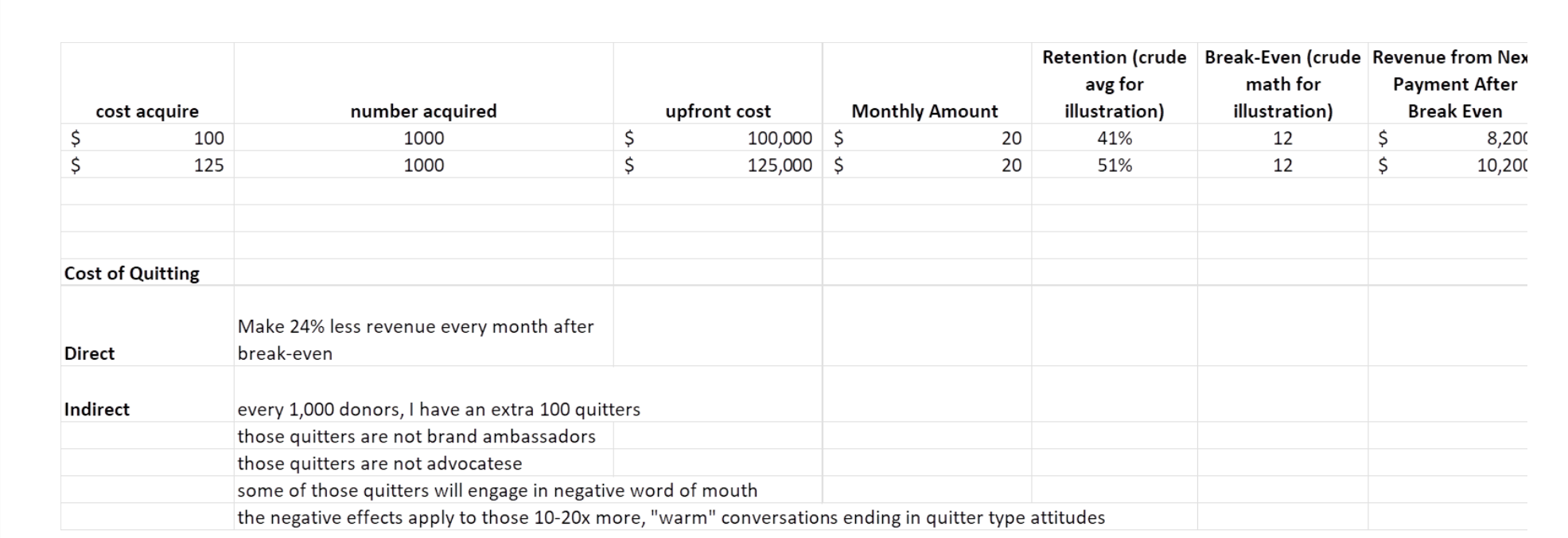

This chart illustrates the importance of retention and also the high cost of not paying attention to quitter/attrition rates:

Don’t Ignore the Basics

The formula for fundraising magic is simple and doesn’t require AI or even algebra:Retention + donor satisfaction= increased lifetime value.

Only by taking the fundamental metrics of retention and lifetime value into account can you manage and steer an effective monthly giving acquisition effort or any other type of fundraising program.

Roger

P.S. All of the above holds true –on steroids for digital. Cheap clicks and open rates mean little. The real measure of true cost and return is the conversion, retention, and lifetime value metrics of those digital donors.

100%! agreement. Thanks, Roger.