What Happens When All the Paper Checks Are Gone?

There was a day when the last phone call was made by rotary dial. Similarly, the last buggy manufactured, and the last VCR tape inserted.

And someday is a day in the horizon when the last paper check will be written. But we needn’t wait for that day as it’s already dawning and as European readers will cite, the sun (effectively) set on that day a long time ago.

The number of paper checks written in the US shrunk from 41.9 billion checks in 2000 to 16.6 billion in 2018. If that pace only continues linearly, we’ll have fewer than 10 billion checks written in 2030. But the more realistic trendline is exponential decay. And it’s worth noting, this is Federal Reserve data, so it includes business check writing.

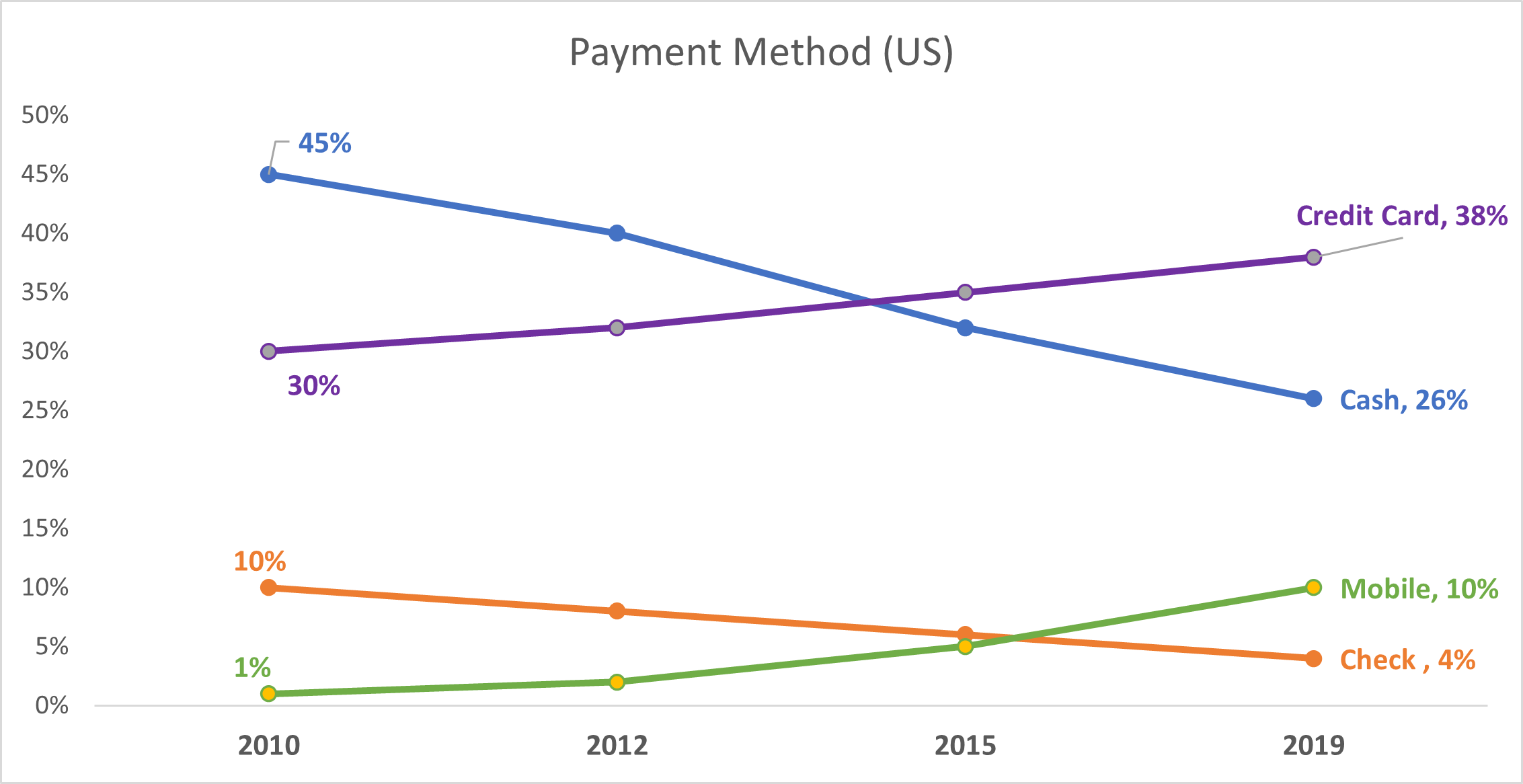

More to the point, it’s the least used payment method by a wide margin. That’s right, cash is still used in a quarter of transactions.

Mail as a communication, marketing and yes, direct raising of money channel isn’t dead, but checks are dying fast and for large swaths of the public, they died a long time ago. Why is our direct mail activation method stuck in a decades ago era?

When was the last time you saw an order form in a commercial mailer catalog? Or any commercial mailing for that matter? It’s very rare.

What if “Make your tax-deductible check payable to….” is actually suppressing results?

Charity direct mail was, is and always will be more about indirect than direct. How so?

There are two indirect benefits:

- Those digital and white mail payments that magically flow in that you occasionally match back and prove were triggered/inspired by the mailing. This is the tinier of the two indirect effects.

- Brand impression. This is measurable with experiments but almost always goes unmeasured and yet it’s, by far, the biggest effect. It cuts both ways too…

But what about the ever-shrinking number of check writers and how to reimagine the activation for the “direct” part of direct mail. Yes, everyone is slapping a QR code on the mailing but seeing low activation, ditto for custom URLs and the longer-lived fantasy that some meaningful numbers of people are going to handwrite their credit card number on a ridiculously tiny piece of paper.

But all those attempts are ancillary and tertiary to the main event, one that hasn’t changed in decades. The tiny reply form and return envelope.

What about, at least as a mental exercise, a test where you didn’t promote checks – no reply form, no return envelope. Instead, it’s an activation insert.

- SMS short code

- Venmo handle

- QR code that calls out digital wallet & CC payment options available by scanning

- Phone number

- Clever/humorous language about checks

- Explanatory text for what the hell each method is and what to expect. I’ve got news for you, there are plenty of people who either don’t know what to do or expect when staring at your ink blot QR code. Even if they used it at a restaurant one time…

Why are we so intent on prioritizing, to the extreme, the least popular payment method that is only becoming less so?

Or how about direct mail as lead-gen? Financial services firms do this, and their response rate is so tiny you need an abacus to count the number of 0’s to the right of the decimal before hitting a non-zero. And to say nothing of the brand-building, marketing direct mail touchpoint with no activation.

These recommended changes are 100% tactical, 0% strategy but still worth doing as there’s first-mover advantage. There is short term upside for doing something different to activate the large number of people receiving your mail who will never write a check and who might be inclined to give “indirectly” but never get around to it – even with you chasing them in digital land.

That first-mover advantage will fade away as copycatting proliferates and we drive new net to zero but that might take a while, maybe even as long as it’s taking for the US Mint to stop producing pennies…yes, we still do.

Kevin

Already dawning? It’s evening already. As European /Belgian I only still vaguely remember how – I was a little kit – my parents did wrote paper checks. When I learned that paper checks are big in US fundraising I first needed to do some research on what this is. I thought it was a kind of fancy high tech fundraising technology I didn’t new yet.

The good news…. fundraising still works without those paper checks.

Ilja, we Americans still only have paper books and print film too. Good luck at IFC.

Well Kevin, I’m still writing cheques (sorry in the UK) but you’re right of course. I write perhaps six a year rather than 60 and more importantly haven’t written one to a charity for several years. The idea of recognising, reacting, and of course testing alternative prompts and triggers is vital.

Hi Peter. I too still write a check on occasion but only as last resort and then, begrudgingly. To say we’re late to this reality as a sector is a bit of an understatement, like Kodak still selling Kodachrome (on their way to filing for chapter 11).

As always, spot on. I think fundraisers are terrified of excluding anyone or any method having been told for years to make it easy to give! However recognising reality and doing something about it might just avoid chapter 11 😖

Peter, I think that’s kinda the point, the near exclusive focus on paper check is wildly exclusionary. When one does a matchback the “direct mail” donor is 40-60, not 70 plus. But we ain’t making it easy for those 40–60-year-olds who must set aside the mail, make a mental reminder to go online, follow through, etc.

And this is to say nothing of the massive, missed need and opportunity to do auto-renew. The monthly giving option is also wildly exclusionary. There are lots of other options that seem silly to list but maybe still worth doing – 1x, 2x, 4x. is it really one-off or 12x? Silly. And there are lots of ways to do this activation with paper reply (think check box to auto-renew via ACH) and obv even more online.

Hi Kevin, thanks so much for the stats on this… if we look at what happened in the Netherlands, New Zealand, now going in Australia, it’s coming our way. If you ask someone if they have a check book, younger people look at you like what’s that? they all use their phone and bank account to pay. The reality is that here in the US we’d all want people to go online and donate but then we’re not making it that easy for them to do so.

I don’t think it’s smart to do away with reply forms and reply envelopes yet as donors can indicate their credit card information or donors can choose to start giving monthly by completing their card or even bank account information. But we need to stop asking for a first month’s or a voided check if the donor does not have this. We can ask for routing number and account number instead and I’m slowly starting to see that trend emerging.

I did a test recently with a monthy donor invite by mail and we asked for the bank info first and card info second to start a monthly gift and the number of people starting an ACH/electronic bank transfer monthly gift was much higher, so that approach may be worth testing elsewhere. I’m seeing it occasionally on online forms where EFT/ACH/echeck is preselected…

Now’s the time to start considering ways to make up for losing out on check writers as they’re getting older and older and eventually fade away… There are a few wonderful case studies from some other countries on how to best prepare for those days… nonprofits may need to refocus their efforts on generating even more monthly donors while there’s still time but do evaluate what information you’re asking for. Check out this post I wrote a while back. https://adirectsolution.com/2022/04/16/what-if-checks-were-going-away/

Thanks Kevin! I was wondering the same thing about checks – recently stumbled on this interesting article: https://www.washingtonpost.com/business/2023/09/15/paper-checks-who-uses/

“In particular, we still reach for the old checkbook when dealing with contractors, charities, taxes”

Hi Emily, thanks for the read, comment and article share. I have no data on this, but I’d hypothesize being on par with contractors is a negative and reflects the only payment option offered and/or heavily encouraged, but not the preferred way for the vast majority. My very limited check writing is disproportionately for contractors who offer no other payment method, which is frustrating and friction creating.

Hi Kevin

We have a real example over here. Aotearoa/New Zealand scrapped cheques a bit ago. Consequently a great case study of what to do and what not to do.

1) don’t delay. It may be 10 years away in the USA but the quicker you start with alternative methods and growing trust in credit cards the better

2) don’t just circle the wagons and try to stop it – also try to get banks to help the transition through coordinating multi charity pressure.

With our NZ experience we’ve been helping Australian, W European and N American fundraisers start planning. All the ideas you talk about get a big tick. But despite that, it still hurt quite a few organisations.

Hi Sean, Thanks for the read and feedback about New Zealand, very helpful. One question, can you expand a bit on what you mean by getting the banks to help through the transition? Thanks again,

Hiya,

Sorry to pop in so late… But I think this statement is silly:

“no reply form, no return envelope. Instead, it’s an activation insert.”

Do you think older donors are sending checks just because there’s a return envelope/reply form? It’s more the reverse… we’re still including these because it’s the way older donors are comfortable giving. The pandemic was the perfect test of shifting older donors to online giving. Some moved online but many didn’t. The online giving stats rose and then dipped again.

We’ve been using the reply form to highlight multiple ways to give, for well over a decade. And yet… we still have the majority of donations coming in by check and some people still write down their credit card details and send them to us (eeek).

Your idea that we’re somehow “prioritizing” checks has this backward. We’re maintaining the methods our donors clearly prefer, while trying to nudge them toward other methods.

Dropping the return envelope and reply form smacks of “teaching donors how to give properly”. Oh dear.

We highlight the ease of online giving… “put your gift right to work”.

We invite donors to call us.

We include a monthly giving form(SEPA in the EU)

We include a QR code with an explanation of how to use it.

And donors use the method they’re comfortable with. This will change, over time, by age cohort, and by what becomes normal in everyday business. But thinking we will change donors behavior by suddenly leaving out the reply envelope is ludicrous and will drop response rates.

I would encourage every fundraiser and consultant to spend as much time as possible with your donor care teams. These are the people who can tell you what donors want and how donors really behave. We need to let donors teach us how they are most comfortable giving. Pressuring them to change is not the way. Offering them options and making it easier, is our way forward.

Denisa,

If you look at match back data the age cohort that gives the most to direct mail is not 70+, it is 40–60-year-olds.

And my argument is not removing check writing as an option but apparently that got lost in the mental exercise.

Yes, check writing is predicted by age, not surprising. But guess what predicts check writing more than age? Race. White people write way more checks and this analysis controls for the effects of age, income, etc.

I’d further argue age is mostly descriptive, rarely causal or insightful of much of anything and about as far from what should be the backbone of your fundraising as that vestigial organ, the appendix.

I’d submit that direct mail has lots of room to optimize and that includes the lowly reply form.

Also… do you have that chart broken out by age cohort?

Because a chart tracking the same age cohorts that are the backbone of fundraising will look very different than the population as a whole.